While there are many packages of there to support such endeavors, I have written my own framework to accomplish this. In a nutshell, I have separated out the execution layer, data layer and logic layers of a trading program. The execution layer takes care of the communication and physical trade execution at my broker. The data layer is separated out to render feeds of price and other information for use by any particular strategy I am running. Finally the logic layer is separated out into individual strategies running within the framework.

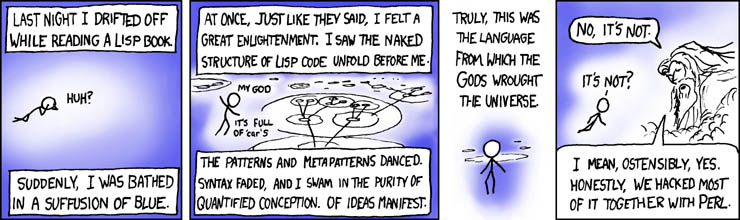

It sounds much more complicated than it really is. But having this proper framework allows me to code strategies easily; and then run them thru backtesting or live mode. I suppose I would be remiss if I didn't also mention I did this all in PERL.

No comments:

Post a Comment